One Crucial Resource for Assessors Handling Property Tax Disputes

Assessment professionals are responsible for appraising properties within their districts for accurate, fair, and equitable values. This ensures that each property owner pays just the right amount to the local tax rolls in order to secure adequate funds for local public school districts, public safety, public works, and other essential services.

Occasionally, however, property owners will dispute the assessed value of their home if they believe a mistake was made, and they file an appeal in their jurisdiction. For homeowners, the process for an appeal is typically straightforward. Those who believe that their homes have been assessed at more than they are worth will typically file an appeal through their local assessment or appraisal office, either online or in person.

Many property owners file appeals without a third party, such as a lawyer or an independent appraiser, but some will use these services. It’s especially common for homeowners to ask for a reassessment if their home has significant damage they can’t afford to fix or that would drop the sale price of the home by thousands of dollars.

However, residential property owners aren’t the only ones who may dispute their assessed property values. Regions with big box stores and other high-value commercial properties are likely to face appeals – many of which are far more complicated than a residential appeal.

As a report from Good Jobs First explains, assessors use a number of methods to determine market value. Assessors look at the income a property can generate, the cost of constructing a similar property, and the amount that similar properties have sold for recently.

With commercial properties, it’s common for assessors to value the property at its “highest and best use,” or “at whatever function makes the most money from the property in its current condition,” according to the San Antonio Express-News.

Yet large retail outlets often appeal these appraised values, stating that they should be valued as “dark stores,” or vacant buildings that have shut down. They argue that once they try to sell the retail outlet or other commercial building, the amount they receive will be far lower than what they may have initially paid to construct the facility.

In some areas, such appeals have gone to court or required significant arbitration between the assessor’s office and the corporation. The typical homeowner files their appeal – with or without legal help – and accepts the assessor’s decision one way or the other. Large corporations, though, have far greater financial resources at their disposal and aren’t afraid to hire high-priced lawyers and consultants.

Whether the appeal comes from a homeowner or a commercial property, there are some tools that assessors can have at their disposal. The big one: comprehensive aerial imagery and data.

How can assessors use this technology to serve their districts? Here are a few different aerial imagery and data solutions that assessors can use in the appraisal and appeal processes.

Orthogonal and oblique aerial imagery captured at low altitudes

Using internet satellite imagery may sound like an easy way to get property information, but these photographs are typically low-quality, and they may not provide an accurate view of a property or region. Aerial imagery captured in a manned aircraft is taken from a lower altitude, so what’s on the ground is clearer and not obscured by atmospheric degradation.

With regularly updated imagery, assessors have a clear view of what’s going on in their jurisdictions. Orthogonal imagery gives a top-down view of properties, making it easy to see size and shape and identify outbuildings. Oblique imagery, taken from a 40- to 45-degree angle, allows for easier object recognition and shows property from a realistic perspective that satellite can’t offer.

For assessors, these images allow for property inspections right from a desktop, saving time and funds on site visits. Viewing Pictometry® imagery in the CONNECTExplorer™ platform lets assessors view GIS layers, add notations, create workspaces, use measurement tools, and extrapolate other property-related data. In the event of a dispute, assessors have actionable imagery to support their decisions or evaluate the homeowner’s appeal. Should the need for a site visit arise, the CONNECTMobile™ application lets assessors take notes in the field and sync them with their CONNECTExplorer data upon return to the office.

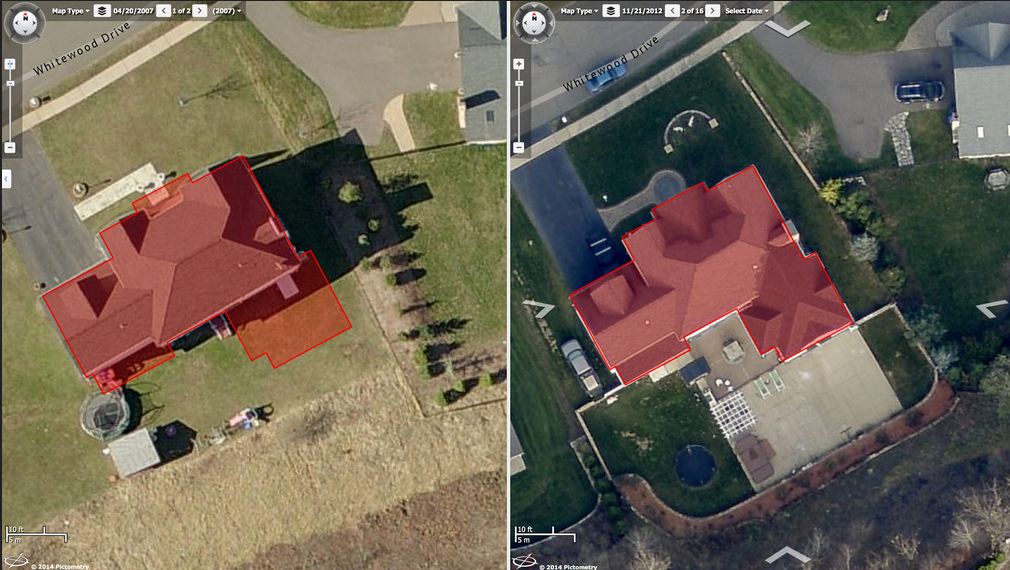

An example of ChangeFinder deliverables.

Change detection software to show year-over-year modifications

Tracking change throughout a jurisdiction can be difficult, especially in fast-growing areas. Viewing historical aerial imagery alongside recent image capture can give assessors property change data in order to update their valuations.

ChangeFinder™, an add-on in the CONNECTAssessment™ platform, allows assessors to view year-over-year changes right on their desktops. This saves assessors time by cutting out site visits or skimming through stacks of paperwork, and it helps assessors see improvements made without permits.

GIS integrations available to the public

With aerial imagery and GIS data, assessors can view properties right from their desks. But what if community members want the ability to see their properties? The Integrated Pictometry Application (IPA) operates in an iframe web browser and lets users search locations, see multiple views of a property, and compare current and historical imagery.

When property tax disputes arise, having comprehensive imagery and data makes it simple to review the facts and avoid other common stresses of the job. Aerial images help assessors quickly point out the reasons for a decision and more easily find comparable properties in a region. Incorporating property-centric GIS data in the CONNECTExplorer platform makes it easy to track changes for fair and equitable assessments.